Deposit of revenue from motor vehicle privilege and use taxes

Amended by SB 1558

Effective since June 3, 2022

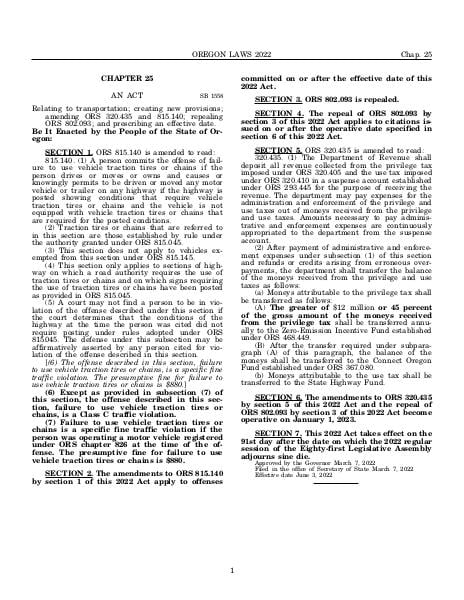

Relating to transportation; creating new provisions; amending ORS 320.435 and 815.140; repealing ORS 802.093; and prescribing an effective date.

Source:

Section 320.435 — Deposit of revenue from motor vehicle privilege and use taxes, https://www.oregonlegislature.gov/bills_laws/ors/ors320.html.