Provisions in ORS chapters 305, 314, 315 and 317 incorporated into corporation income tax law

Amended by SB 1502

Effective since June 3, 2022

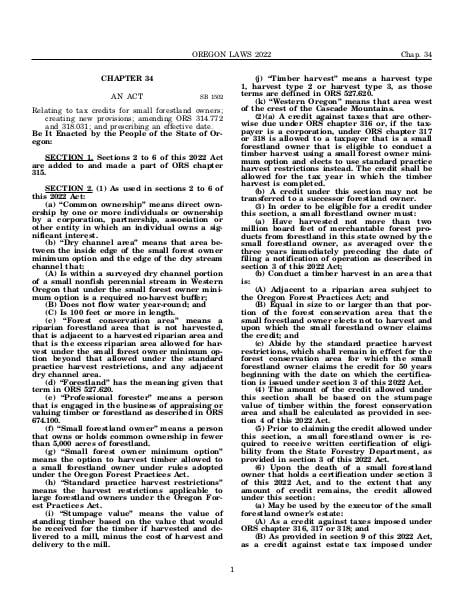

Relating to tax credits for small forestland owners; creating new provisions; amending ORS 314.772 and 318.031; and prescribing an effective date.

Source:

Section 318.031 — Provisions in ORS chapters 305, 314, 315 and 317 incorporated into corporation income tax law, https://www.oregonlegislature.gov/bills_laws/ors/ors318.html.