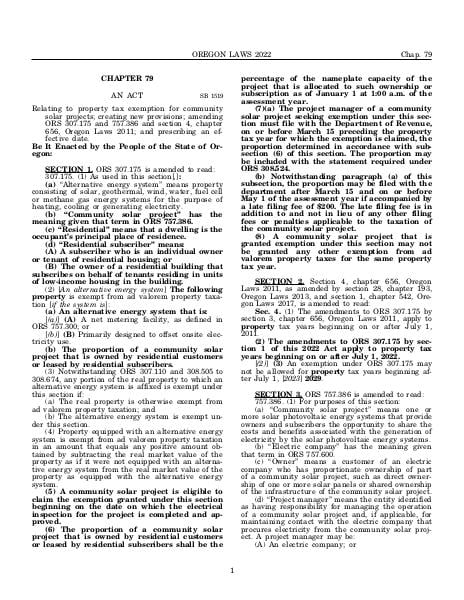

ORS 307.175

Alternative energy systems

Amended by SB 1519

Effective since June 3, 2022

Relating to property tax exemption for community solar projects; creating new provisions; amending ORS 307.175 and 757.386 and section 4, chapter 656, Oregon Laws 2011; and prescribing an effective date.

(1)

As used in this section, “alternative energy system” means property consisting of solar, geothermal, wind, water, fuel cell or methane gas energy systems for the purpose of heating, cooling or generating electricity.(2)

An alternative energy system is exempt from ad valorem property taxation if the system is:(a)

A net metering facility, as defined in ORS 757.300 (Net metering facility allowed to connect to public utility); or(b)

Primarily designed to offset onsite electricity use.(3)

Notwithstanding ORS 307.110 (Public property leased or rented by taxable owner) and 308.505 (Definitions for ORS 308.505 to 308.674) to 308.674 (Exemption equal to difference between real market value of company’s centrally assessable property and 130 percent of cost of company’s centrally assessable real and tangible personal property), any portion of the real property to which an alternative energy system is affixed is exempt under this section if:(a)

The real property is otherwise exempt from ad valorem property taxation; and(b)

The alternative energy system is exempt under this section.(4)

Property equipped with an alternative energy system is exempt from ad valorem property taxation in an amount that equals any positive amount obtained by subtracting the real market value of the property as if it were not equipped with an alternative energy system from the real market value of the property as equipped with the alternative energy system. [1975 c.460 §§1,2; 1977 c.196 §§9,10; 1979 c.670 §1; 1991 c.459 §47; 1997 c.534 §1; 2001 c.584 §1; 2007 c.885 §1; 2011 c.656 §3](2)

An exemption under ORS 307.175 (Alternative energy systems) may not be allowed for tax years beginning after July 1, 2023. [2011 c.656 §4; 2013 c.193 §28; 2017 c.542 §1](b)

An agreement entered into under this section:(A)

May not be for a term longer than 20 consecutive years;(B)

Must indicate how the land on which the solar project is located will be treated with respect to the exemption and fee in lieu of property taxes; and(C)

Must set the rate of the fee in lieu of property taxes in accordance with subsection (2) of this section.(c)

If any portion of a solar project is located within the boundaries of an incorporated city, the governing body of the county shall consult with the governing body of the city before entering into an agreement under paragraph (a) of this subsection. An agreement entered into under paragraph (a) of this subsection with respect to a solar project located within the boundaries of the incorporated city is not effective unless the governing body of the city is a party to the agreement.(2)

The fee in lieu of property taxes shall be computed at a rate not less than $5,500, and not more than $7,000, per megawatt of nameplate capacity of the solar project for each property tax year. Megawatt of nameplate capacity shall be carried to the third decimal place.(3)

Intentionally left blank —Ed.(a)

On or before December 31 preceding the first property tax year to which an agreement entered into under this section relates, the owner or person in possession or control of the solar project shall file with the assessor of the county in which the solar project is located and the Department of Revenue a copy of the agreement and the nameplate capacity of the solar project.(b)

For each subsequent property tax year to which the agreement relates, the owner or person in possession or control of the solar project shall include with the statement required under ORS 308.524 (Companies to file statements) the nameplate capacity of the solar project.(c)

A filing made under paragraph (a) of this subsection after December 31 must be accompanied by a late fee of $200. A filing may not be made after March 1 preceding the property tax year to which the filing relates.(4)

Intentionally left blank —Ed.(a)

For each property tax year to which an agreement relates, the department, when certifying and transmitting the assessment roll to the county assessors under ORS 308.505 (Definitions for ORS 308.505 to 308.674) to 308.674 (Exemption equal to difference between real market value of company’s centrally assessable property and 130 percent of cost of company’s centrally assessable real and tangible personal property), shall provide the nameplate capacity of each solar project paying the fee in lieu of property taxes to each assessor of a county in which a solar project is located.(b)

As required under ORS 311.255 (Taxes, other charges of taxing agencies and water improvement company charges collected with county taxes), the county assessors shall extend upon the tax roll against all property constituting a solar project located in the respective counties all fees in lieu of property taxes for the property tax year. The fees shall be apportioned and distributed among the taxing districts having jurisdiction over the property in the proportion that each taxing district’s total tax rate for the property tax year bears to all the taxing districts’ total tax rates for the property tax year.(5)

Intentionally left blank —Ed.(a)

If the owner or person in possession or control of a solar project that has entered into an agreement under this section fails to pay the fee as required under this section, the property constituting the solar project is not exempt for the following property tax year and shall be assessed and taxed as other similar property is assessed and taxed.(b)

Notwithstanding paragraph (a) of this subsection, the property shall be exempt for the following property tax year upon payment, within one year after the date of delinquency, of the delinquent fee plus interest at the rate prescribed in ORS 311.505 (Due dates) (2). Delinquent fees and interest shall be collected in the manner provided for collection of delinquent property taxes on personal property.(6)

Intentionally left blank —Ed.(a)

If the owner or person in possession or control of the solar project fails to pay the fee in lieu of property taxes for more than one year during the term of an agreement entered into under this section, notwithstanding the agreement, the property constituting the solar project shall be disqualified for the exemption and payment of the fee in lieu of property taxes.(b)

Property that is disqualified under this subsection shall:(A)

Be assessed and taxed as other similar property is assessed and taxed.(B)

In addition, be assessed a penalty in an amount equal to one year of the fee in lieu of property taxes for the property. The penalty assessed under this subparagraph shall be distributed in the manner described in subsection (4)(b) of this section.(7)

Intentionally left blank —Ed.(a)

Property constituting a solar project that has received an exemption under ORS 285C.350 (Definitions for ORS 285C.350 to 285C.370) to 285C.370 (Rules) or 307.123 (Property of strategic investment program eligible projects) for any property tax year is not eligible to pay a fee in lieu of property taxes under this section.(b)

Paragraph (a) of this subsection does not apply to property constituting a solar project that was the subject of an application filed pursuant to ORS 285C.350 (Definitions for ORS 285C.350 to 285C.370) to 285C.370 (Rules) if the property did not receive the exemption for any property tax year. The election to pay the fee in lieu of property taxes for property described in this paragraph is not a disqualifying event. [2015 c.571 §1; 2019 c.628 §1; 2021 c.571 §1](2)

Notwithstanding subsection (1) of this section, property constituting a solar project that is exempt from property taxes under section 1, chapter 571, Oregon Laws 2015, on the date specified in subsection (1) of this section shall continue to be exempt and to pay the fee in lieu of property taxes for the term specified in the agreement entered into under section 1, chapter 571, Oregon Laws 2015. [2015 c.571 §3; 2021 c.571 §2](a)

Intentionally left blank —Ed.(A)

“Eligible costs” means costs that are:(i)

Directly related to the work necessary to seismically retrofit eligible property; and(ii)

Incurred after an application relating to the retrofitting has been approved under section 2 of this 2017 Act.(B)

“Eligible costs” includes, but is not limited to:(i)

All costs directly related to structural seismic retrofitting, including, but not limited to, the necessary costs of demolition and restoration of similar architectural finishes, electrical systems, plumbing and mechanical systems necessary for access; and(ii)

Architectural and engineering fees, and fees for testing, insurance and project management, related to the seismic retrofitting.(C)

“Eligible costs” does not include:(i)

Costs associated with refurbishing or remodeling that are intended to enhance the aesthetics, functionality or marketability of the improvements but do not extend the seismic life safety of the improvements; or(ii)

Costs for abatement of hazardous materials, including, but not limited to, asbestos, or for relocation or loss of rent during the seismic retrofitting.(b)

“Eligible property” means improvements built before January 1, 1993, that constitute a commercial, industrial or multifamily building.(2)

The governing body of a city or county may adopt an ordinance or resolution providing for exemption or partial exemption from ad valorem property taxation of eligible property that will be seismically retrofitted.(3)

Intentionally left blank —Ed.(a)

An ordinance or resolution adopted under this section must specify the eligibility requirements for the exemption or partial exemption.(b)

Notwithstanding paragraph (a) of this subsection, property is not eligible for an exemption or partial exemption pursuant to this section if, at the time an application for the property is filed under section 2 of this 2017 Act, the property is:(A)

Subject to assessment under ORS 308.505 (Definitions for ORS 308.505 to 308.674) to 308.681 [series became 308.505 (Definitions for ORS 308.505 to 308.674) to 308.674 (Exemption equal to difference between real market value of company’s centrally assessable property and 130 percent of cost of company’s centrally assessable real and tangible personal property)]; or(B)

State-appraised industrial property as defined in ORS 306.126 (Appraisal of industrial property by department).(4)

Intentionally left blank —Ed.(a)

An ordinance or resolution adopted under this section must specify the period, not to exceed 15 years, for which the exemption or partial exemption may be granted.(b)

Eligible property may be granted exemption or partial exemption under this section until the earlier of:(A)

The expiration of the period for which the eligible property is eligible for exemption or partial exemption under paragraph (a) of this subsection; or(B)

The date on which the dollar amount of the tax benefit from the exemption or partial exemption equals the eligible costs for the property.(c)

The ordinance or resolution may:(A)

Further restrict eligible properties to unreinforced masonry buildings, unreinforced concrete buildings or any other building type considered seismically dangerous by the governing body of the city or county; and(B)

Impose any other conditions for the exemption or partial exemption that do not conflict with sections 1 to 5 of this 2017 Act.(5)

Intentionally left blank —Ed.(a)

A city or county may amend or repeal an ordinance or resolution adopted under this section at any time.(b)

Notwithstanding paragraph (a) of this subsection, eligible property that is granted an exemption or partial exemption under this section when the ordinance or resolution is amended or repealed shall continue to receive the exemption or partial exemption for the period granted, pursuant to the provisions of the ordinance or resolution in effect when the property was initially granted the exemption or partial exemption.(6)

Intentionally left blank —Ed.(a)

An ordinance or resolution adopted under this section does not become effective unless the rates of taxation of the taxing districts located within the territory of the city or county whose governing bodies agree to the exemption or partial exemption, when combined with the rate of taxation of the city or county that adopted the ordinance or resolution, equal 75 percent or more of the total combined rate of taxation within the territory of the city or county. In agreeing to the exemption or partial exemption, the governing bodies of the taxing districts shall impose a limit on the total amount of exemptions and partial exemptions that may be approved.(b)

If an ordinance or resolution becomes effective pursuant to paragraph (a) of this subsection, the exemption or partial exemption shall be effective for the tax levies of all taxing districts in which an eligible property that is granted an exemption or partial exemption is located. [2017 c.537 §1](b)

Notwithstanding paragraph (a) of this subsection, an application may be filed after March 15 and on or before December 31 if the application is accompanied by a late filing fee equal to the greater of $200 or one-tenth of one percent of the real market value of the eligible property to which the application relates as of the assessment date for that tax year.(2)

An application filed pursuant to this section must include:(a)

The address of the eligible property.(b)

Documentation showing the ownership of the eligible property by the person filing the application.(c)

Documentation showing that all applicable eligibility requirements have been met.(d)

Documentation of estimated eligible costs with respect to the eligible property prepared by a person unrelated to the owner of the eligible property and having expertise in estimating such costs. Documentation of eligible costs may include, but is not limited to, bids, cost estimates, copies of contracts, notes and minutes of contract negotiations and accounts, invoices, sales receipts and other payment records of purchases, sales, leases and other transactions relating to the eligible costs.(e)

Plans, calculations and any other documentation prepared and stamped by a registered structural engineer or architect establishing to the satisfaction of the city or county that the proposed seismic retrofitting meets or exceeds the standard defined as Basic Performance Objective for Existing Buildings in the Seismic Evaluation and Retrofit of Existing Buildings ASCE/SEI 41-13, published by the American Society of Civil Engineers and the Structural Engineering Institute, as in effect on December 31, 2016, unless the governing body of the city or county has expressly approved or required a different standard that enhances life safety in a seismic event. The documentation must include seismic retrofitting for any parapets, cornices and chimneys. The standard of care for documentation prepared and stamped under this paragraph is the same as for documents stamped in accordance with ORS 671.025 (Certain drawings and specifications to carry stamp) or 672.020 (Practice of engineering without registration prohibited).(f)

Documentation of any financial incentives received from local, state or federal government for the seismic retrofitting of the eligible property, exclusive of the exemption or partial exemption granted under sections 1 to 5 of this 2017 Act.(g)

An application fee, if any, required by the city or county.(3)

The application shall be reviewed by the city or county. The city or county may consult with the owner of the eligible property about the application, and the owner may amend the application.(4)

Intentionally left blank —Ed.(a)

If the city or county determines that the application does not meet the requirements of this section, the city or county shall promptly notify the owner of the eligible property in writing that the application is not approved, stating the reasons for the determination. A determination under this paragraph is not reviewable, but the owner of the eligible property may file an application under this section for any subsequent year.(b)

If the city or county determines that the application meets the requirements of this section, the city or county shall promptly:(A)

Notify the owner of the eligible property in writing that the application is approved; and(B)

Notify the county assessor in writing that the application is approved and certify the period for which the exemption or partial exemption is granted and the estimated eligible costs with respect to the eligible property, reduced by any financial incentives received from local, state or federal government for the seismic retrofitting of the eligible property, exclusive of the exemption or partial exemption granted under sections 1 to 5 of this 2017 Act.(5)

The assessor of the county in which the eligible property granted an exemption or partial exemption is located may charge the owner a fee of up to $200 for the first year and up to $100 for each subsequent year for which the exemption or partial exemption is granted to compensate the assessor for duties imposed under sections 1 to 5 of this 2017 Act.(6)

Upon receiving notice under subsection (4) of this section of the approval of an application, the owner of the eligible property shall cause to be recorded with the clerk of the county in which the eligible property is located a notice that contains a legal description of the eligible property and a statement that the eligible property has been granted a property tax exemption pursuant to an ordinance or resolution adopted under section 1 of this 2017 Act and that the owner, or the owner’s successor or assignees, may be liable for additional taxes under section 5 of this 2017 Act.(7)

The transfer of the eligible property shall not disqualify the eligible property from an exemption or partial exemption granted to the eligible property under the ownership of the transferor, provided the transferee:(a)

Notifies the city or county and the county assessor as soon as practicable of the transfer and of the transferee’s intention to continue the seismic retrofitting in a manner consistent with the requirements of sections 1 to 5 of this 2017 Act; and(b)

Complies with all requirements under sections 1 to 5 of this 2017 Act. [2017 c.537 §2](2)

The exemption or partial exemption shall apply to existing eligible property of any classification under rules established by the Department of Revenue pursuant to ORS 308.215 (Contents of assessment roll) (1)(a)(C) that is consistent with the definition of “eligible property” under section 1 of this 2017 Act.(3)

ORS 307.032 (Maximum assessed value and assessed value of partially exempt property and specially assessed property) applies to eligible property granted partial exemption under the ordinance or resolution.(4)

Each year the county assessor shall add to the assessment and tax rolls of the county, with respect to the eligible property granted exemption or partial exemption pursuant to an ordinance or resolution adopted under section 1 of this 2017 Act, the notation “potential additional tax.” [2017 c.537 §3](b)

The owner shall include with the documentation the amount of any financial incentives received from local, state or federal government for the seismic retrofitting of the eligible property, exclusive of the exemption or partial exemption granted under sections 1 to 5 of this 2017 Act. The city or county shall report the amount of the incentives to the assessor of the county in which the eligible property is located, who shall reduce the eligible costs for the eligible property by the amount of the incentives.(2)

Intentionally left blank —Ed.(a)

If the updated estimate of the eligible costs is greater or less than the original estimate by 10 percent or more, the city or county shall submit the documentation and updated estimate to the county assessor.(b)

Upon receipt, the county assessor shall recompute the assessed value and maximum assessed value of the eligible property under ORS 308.156 (Subdivision or partition), beginning with the first year for which the eligible property was granted exemption or partial exemption.(c)

The values as recomputed under this section shall apply to the remaining period for which the eligible property has been granted exemption or partial exemption. Delinquent taxes may not be assessed or collected, and refunds may not be paid, as a consequence of the recomputation under this section for property tax years preceding the remaining period. [2017 c.537 §4](a)

The expiration of the period for which the exemption or partial exemption was certified under section 2 of this 2017 Act.(b)

The date on which the dollar amount of the exemption or partial exemption equals the eligible costs for the eligible property.(c)

The discovery by the city or county that the owner of the eligible property has failed to:(A)

Comply with the eligibility requirements adopted by the city or county;(B)

Begin or make reasonable progress on seismic retrofitting of the eligible property; or(C)

Perform the seismic retrofitting of the eligible property in substantial compliance with documentation described in section 2 (2)(e) of this 2017 Act that was included in the application relating to the eligible property approved under section 2 of this 2017 Act.(d)

The discovery by the city or county that any statement or representation in any documentation filed pursuant to section 2 of this 2017 Act was misleading or false.(2)

The city or county may provide an owner with the opportunity to cure the grounds for disqualification under subsection (1) of this section.(3)

The city or county shall notify the county assessor of the disqualification of eligible property from exemption or partial exemption under this section, and upon disqualification the eligible property shall be assessed and taxed under ORS 308.146 (Determination of maximum assessed value and assessed value).(4)

Upon disqualification of eligible property from exemption or partial exemption under subsection (1)(c) or (d) of this section, there shall be added to the tax extended against the eligible property on the next assessment and tax roll, to be collected and distributed in the same manner as other property taxes, additional taxes, equal to the difference between the taxes assessed against the eligible property and the taxes that otherwise would have been assessed against the eligible property if the eligible property had not been granted exemption or partial exemption, for all years for which the eligible property was granted exemption or partial exemption.(5)

Additional taxes collected under this section shall be deemed to have been imposed in the year to which the additional taxes relate.(6)

The amount of additional taxes determined to be due under this section may be paid to the tax collector prior to the completion of the next assessment and property tax roll pursuant to ORS 311.370 (Receipts for taxes collected in advance of extension on the tax roll). [2017 c.537 §5](2)

Notwithstanding the date specified in subsection (1) of this section, eligible property that is granted exemption or partial exemption under an ordinance or resolution adopted pursuant to section 1 of this 2017 Act before the date specified in subsection (1) of this section shall continue to receive the exemption or partial exemption under the provisions of the ordinance or resolution for the period of time for which the exemption or partial exemption was granted. [2017 c.537 §6]

Source:

Section 307.175 — Alternative energy systems, https://www.oregonlegislature.gov/bills_laws/ors/ors307.html.

Notes of Decisions

Term “equipped” is too broad to conclude that energy produced by alternative energy system must be used on property where energy is produced. Pegar v. Dept. of Rev., 11 OTR 328 (1990)

Attorney General Opinions

Tax credit for installation of alternative energy devices, (1977) Vol 38, p 1198