Definitions for ORS 307.651 to 307.687

Amended by HB 4064

Effective since March 23, 2022

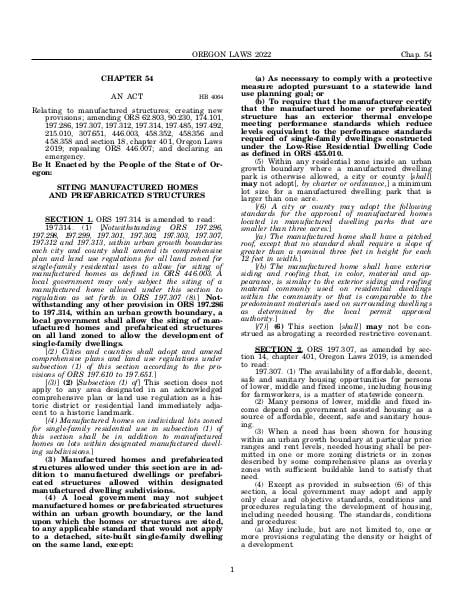

Relating to manufactured structures; creating new provisions; amending ORS 62.803, 90.230, 174.101, 197.286, 197.307, 197.312, 197.314, 197.485, 197.492, 215.010, 307.651, 446.003, 458.352, 458.356 and 458.358 and section 18, chapter 401, Oregon Laws 2019; repealing ORS 446.007; and declaring an emergency.

Source:

Section 307.651 — Definitions for ORS 307.651 to 307.687, https://www.oregonlegislature.gov/bills_laws/ors/ors307.html.