ORS 307.480

Definitions for ORS 307.480 to 307.510

Amended by HB 4005

Effective since March 9, 2022

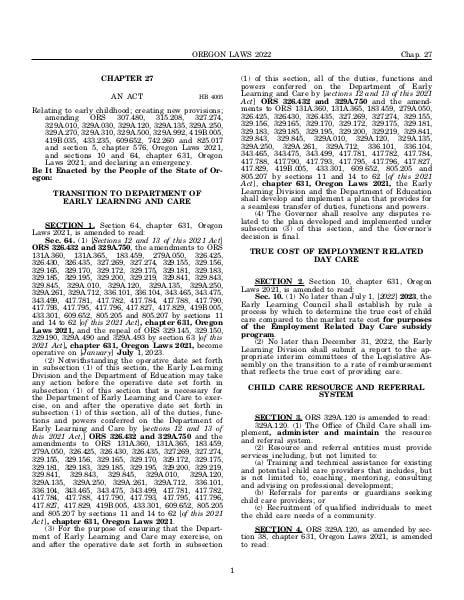

Relating to early childhood; creating new provisions; amending ORS 307.480, 315.208, 327.274, 329A.010, 329A.030, 329A.120, 329A.135, 329A.250, 329A.270, 329A.310, 329A.500, 329A.992, 419B.005, 419B.035, 433.235, 609.652, 742.260 and 825.017 and section 5, chapter 576, Oregon Laws 2021, and sections 10 and 64, chapter 631, Oregon Laws 2021; and declaring an emergency.

(1)

“Agricultural workforce housing” means housing:(a)

That is limited to occupancy by agricultural workers, including agricultural workers who are retired or disabled, and the immediate family members of the agricultural workers; and(b)

No dwelling unit of which is occupied by a relative of the owner or operator of the agricultural workforce housing, other than a manufactured dwelling in a manufactured dwelling park nonprofit cooperative as defined in ORS 62.803 (Definitions for ORS 62.800 to 62.815).(2)

“Eligible agricultural workforce housing” means agricultural workforce housing that:(a)

Is owned or operated by a nonprofit corporation as a nonprofit facility;(b)

Is not provided in connection with the recruitment or employment of agricultural workers; and(c)

Complies with all applicable local, state and federal building codes.(3)

“Eligible child care facility” means a child care facility that is:(a)

Certified under ORS 329A.030 (Central Background Registry) and 329A.250 (Definitions for ORS 329A.030 and 329A.250 to 329A.450) to 329A.450 (Assistance to staff of facility);(b)

Owned or operated by a nonprofit corporation as a nonprofit facility; and(c)

Operated in conjunction or cooperation with an eligible farm labor camp.(4)

“Eligible farm labor camp” means a farm labor camp that:(a)

Is owned or operated by a nonprofit corporation as a nonprofit facility; and(b)

Complies with the safety and health standards for agricultural labor housing and related facilities adopted under the Oregon Safe Employment Act.(5)

“Farm labor camp” means any place, area or piece of land where housing or sleeping places are owned or maintained:(a)

By a person engaged in the business of providing housing or sleeping places for employees or prospective employees of another person and the immediate families of the employees or prospective employees if the employees or prospective employees are or will be engaged in agricultural work. Eligible farm labor camps may provide housing to workers not currently engaged in agricultural work if agricultural work is not available and employees or prospective employees are required either to engage in agricultural work or to leave the farm labor camp once agricultural work becomes available in the area.(b)

In connection with any work or place where agricultural work is being performed, whether the housing or sleeping places are owned or maintained by the employer or by another person.(6)

“Owned or operated by a nonprofit corporation as a nonprofit facility” includes, but is not limited to:(a)

The possession or operation of agricultural workforce housing, child care facility or farm labor camp property by a nonprofit corporation pursuant to a written lease or lease-purchase agreement if:(A)

The nonprofit corporation is obligated under the terms of the lease or lease-purchase agreement to pay the ad valorem taxes on the property used in operating the agricultural workforce housing, child care facility or farm labor camp; or(B)

The rent payable by the nonprofit corporation has been established to reflect the savings resulting from the exemption from taxation.(b)

The possession or operation of the property by a partnership of which the nonprofit corporation is:(A)

A general partner or the general manager; and(B)

Responsible for the day-to-day operation of the property.(7)

Intentionally left blank —Ed.(a)

“Rental” means the net amount of income from eligible agricultural workforce housing, an eligible child care facility or an eligible farm labor camp after deduction of costs paid or incurred in the operation of the housing, facility or camp.(b)

Deductible costs under this subsection:(A)

Include, but are not limited to, salaries or other compensation, insurance, utilities, garbage disposal, supplies, repairs and maintenance, interest and capital costs, whether capitalized and depreciated or amortized or deducted currently.(B)

Do not include in lieu taxes imposed under ORS 307.490 (Payments in lieu of taxes). [1973 c.382 §1; 1991 c.232 §1; 1993 c.168 §1; 1995 c.278 §33; 2015 c.34 §1]

Source:

Section 307.480 — Definitions for ORS 307.480 to 307.510, https://www.oregonlegislature.gov/bills_laws/ors/ors307.html.