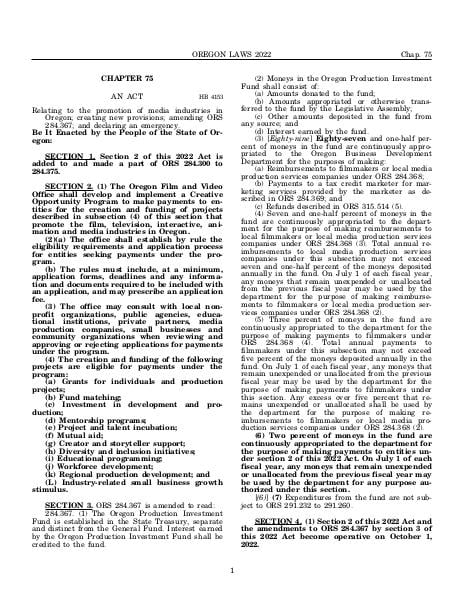

Oregon Production Investment Fund

- source of moneys in fund

- uses of moneys

Amended by HB 4153

Effective since March 23, 2022

Relating to the promotion of media industries in Oregon; creating new provisions; amending ORS 284.367; and declaring an emergency.

Source:

Section 284.367 — Oregon Production Investment Fund; source of moneys in fund; uses of moneys, https://www.oregonlegislature.gov/bills_laws/ors/ors284.html.