Definitions for ORS 178.300 to 178.360

Amended by SB 1525

Effective since June 3, 2022

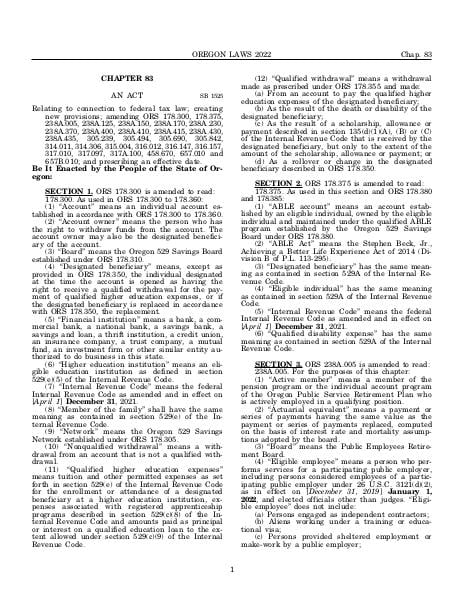

Relating to connection to federal tax law; creating new provisions; amending ORS 178.300, 178.375, 238A.005, 238A.125, 238A.150, 238A.170, 238A.230, 238A.370, 238A.400, 238A.410, 238A.415, 238A.430, 238A.435, 305.239, 305.494, 305.690, 305.842, 314.011, 314.306, 315.004, 316.012, 316.147, 316.157, 317.010, 317.097, 317A.100, 458.670, 657.010 and 657B.010; and prescribing an effective date.

Source:

Section 178.300 — Definitions for ORS 178.300 to 178.360, https://www.oregonlegislature.gov/bills_laws/ors/ors178.html.